Navigating the Waves: Understanding the Recent Plunge in Mortgage Rates and Its Implications for Home Buyers

Navigating the Waves: Understanding the Recent Plunge in Mortgage Rates and Its Implications for Home Buyers

In the dynamic world of real estate, staying informed about economic shifts is crucial. Recently, the Federal Reserve made waves by maintaining interest rates unchanged in their final policy decision of 2023. What’s more intriguing is their forecast – an anticipation to cut borrowing costs three times in the coming year. Let’s delve into what this means for homebuyers, sellers, and the overall real estate landscape.

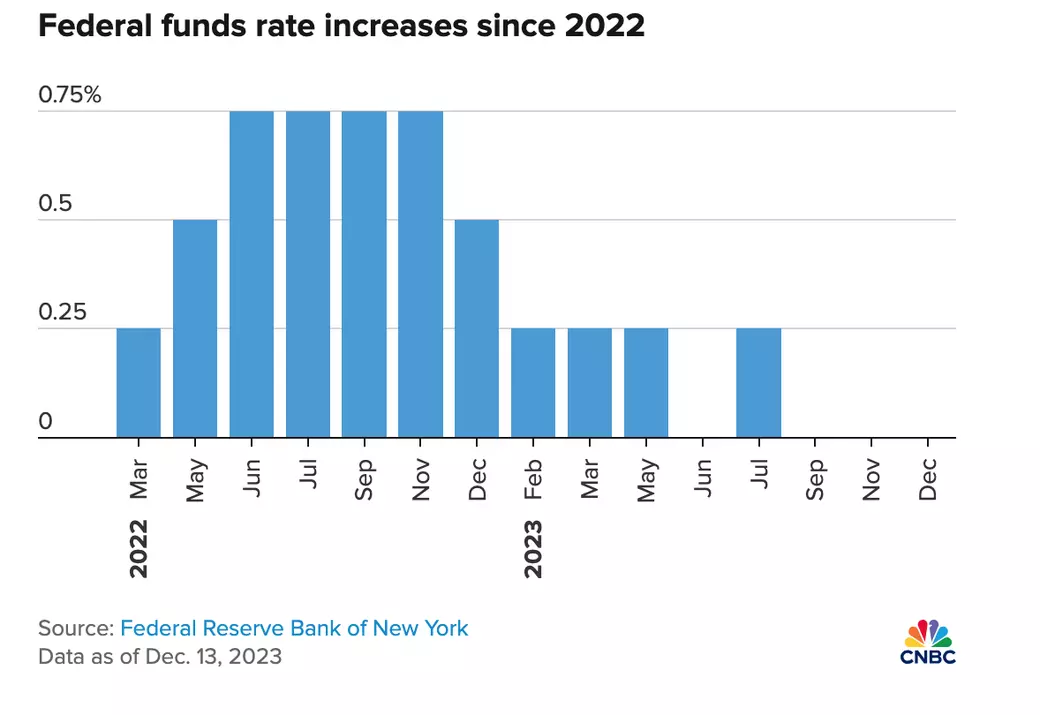

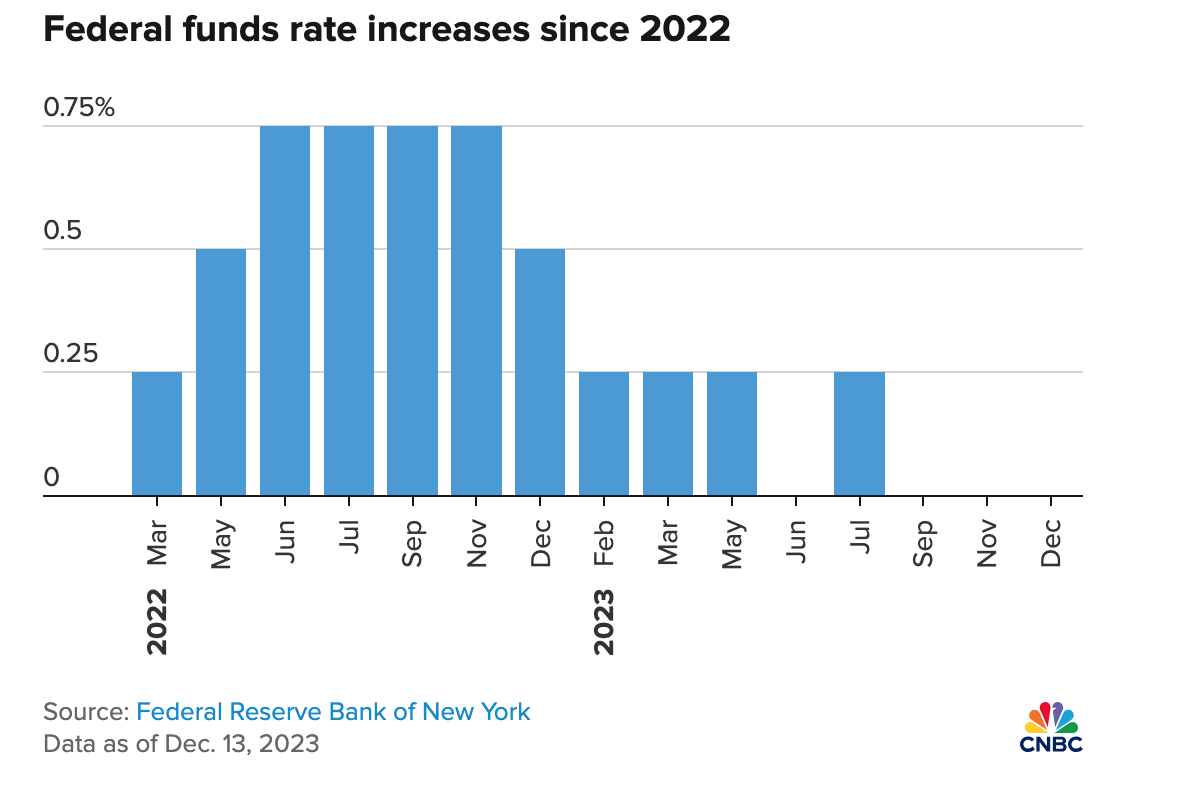

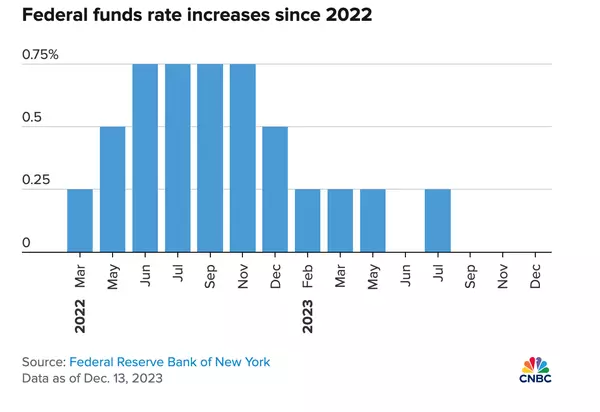

The decision to keep interest rates between 5.25 to 5.5 percent marks a steady stance by the Federal Reserve, maintaining this range since July. To put this in perspective, after a series of rapid increases starting in March 2022, borrowing costs hit their highest level in 22 years by the summer of 2023.

So, what does this mean for you, whether you’re currently in the market or considering a move in the near future? If you’re under contract but haven’t locked in your mortgage rate, now might be the opportune moment. I’ve received calls from various lenders reporting a substantial drop, with some showcasing a remarkable 1% decrease.

This interest rate adjustment is more than just a number; it’s a potential game-changer in the real estate landscape. Lower mortgage rates tend to encourage hesitant buyers to step into the market. As demand rises, and with the existing low supply of homes, we might witness increased competition among buyers. This surge in demand, paired with limited supply, could lead to a subsequent rise in home prices.

While these changes can be exciting, it’s crucial to keep a close eye on the market’s evolution in the coming months. Homeowners may start considering selling as demand rises, potentially alleviating the supply issue. However, many may still hold onto their homes, especially if they secured mortgage rates below 4%.

Change is a constant in the real estate world, and staying informed is your greatest asset. Whether you’re a buyer, seller, or just someone keeping tabs on the market, understanding the implications of the Federal Reserve’s decisions can make all the difference.

As we navigate these waves of change, the Dream to Reality Team is here to guide you through every step. Feel free to reach out if you have questions or are ready to embark on your real estate journey.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "